Life, Death, and Beauty: Damien Hirst in 5 Artworks

Damien Hirst is one of the most influential and controversial figures in contemporary art. His work merges natural science and popular culture with...

Carlotta Mazzoli 16 September 2024

If such words as startups, unicorns, VC funds, and angel investors might seem new to you, or if you have heard them before but don’t understand what all the fuss is about, you are in the right place.

Startups are young companies founded to develop a unique service or product and launch it on the market. They are rooted in innovation, addressing insufficiencies of existing products or creating completely new categories of services.

What is the difference between startups and other types of companies? On a basic level, they work as others do. But when you dig into the details, you will see that startups are all about fast growth and innovation. They are also about the speed of making changes to their products and services, scalability, and a way of being funded. Regular companies duplicate what has been done before; startups create something new. They build on ideas very quickly. They constantly develop the product based on feedback until they have a ready MVP. MVP is a minimum viable product – a basic version of the product that can be tested with beta users and revised until it’s ready to go to market.

There is a preliminary investment called bootstrapping. It is when the founders themselves and their family and friends invest in their business. Sometimes it’s called a FFF investment – Family, Fools, and Friends. After that comes seed funding from angel investors or a VC fund. An angel investor is an individual who puts cash into a startup for a certain amount of equity ownership. A VC fund, on the other hand, is a venture capital firm that provides funds to fast-growing tech companies in exchange for equity as well. They usually are the ones to come in after the preliminary round of funding that a startup gets from FFF. It happens because they like to invest in already existing products or services. The next investments provided by VCs are called Series A, B, C, etc. and the startup receives from tens to hundreds of millions of dollars.

And of course, both sides want the startup to become a unicorn. A unicorn is not just a mythical creature symbolizing purity, freedom, virginity, and innocence. In business, a unicorn is a magical startup that’s value is higher than 1 billion dollars. The most famous unicorns you might have heard about are Stripe (payment platform) and SpaceX (the space company of Elon Musk). According to CB Insights, there are more than 803 unicorns as of August 2021.

So, what does all this have in common with the arts you may ask? The art market, or better to say an art tech market, has for many years been far from angel investors, VC funds, and unicorns. But recently – starting with the NFTs boom, the art tech world has been noticed by a wider audience, including investors.

Physical art was not the thing they wanted to invest in, but starting with the notable sale of Beeple’s Non-Fungible Token, Everydays: the First 5000 Days, encrypted on the blockchain, the art market has gained a lot of attention from the financial world.

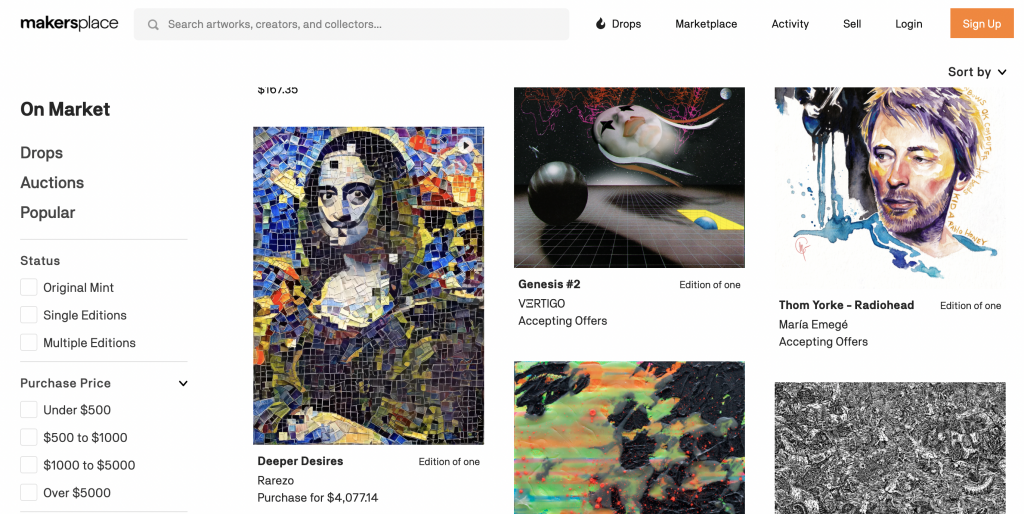

One of the biggest recent successes was that of MakersPlace which has raised 30 mln US of VC money for its series A. Founded in 2018 by Danny Chu from Pinterest, it became famous after bringing to the market the aforementioned Beeple work and selling it for $ 69,3 million. Angel investors for Series A included Bill Ruprecht, a former Sotheby’s chief executive, and Acquavella Galleries, as well as the rapper Eminem and Eventbrite founders Julia and Kevin Hartz.

MakersPlace is a marketplace that offers unique digital works to buyers. It is the perfect tool for creators to protect and sell their digital pieces. It is based on blockchain technology. Artists digitally sign each work on MakersPlace and the art pieces are permanently recorded and verified through the blockchain. A blockchain is a publicly accessible online database that is not owned by any central authority. Once everything is set in the database, it can not be changed or canceled by any authority. The platform is commission based.

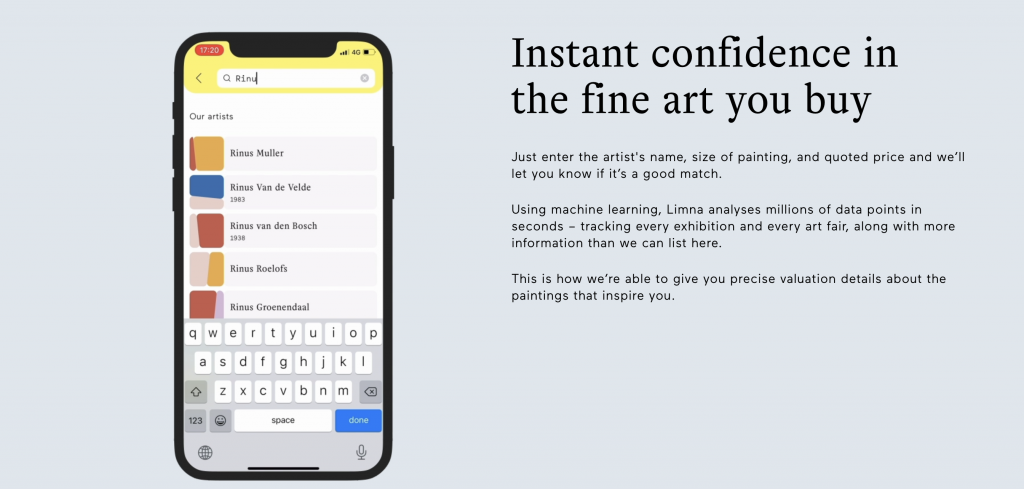

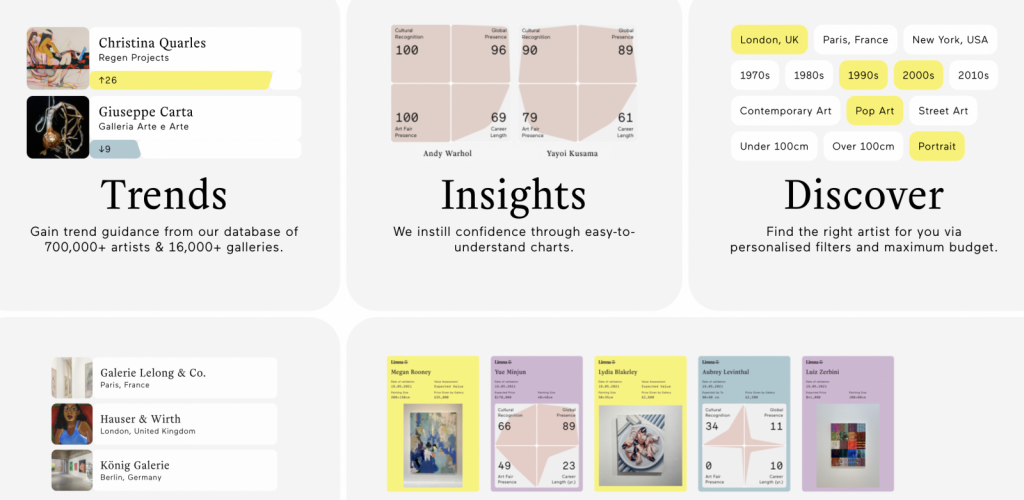

Another interesting startup to follow in 2021 is Limna.ai. If you have ever fallen in love with a piece of art and were tempted to buy it but were not sure if you should and if that is a good investment, then this app is for you. With this tool, you do not have to do independent research to check if a certain piece of art is a savvy investment, not only the drive of your heart. It is important especially when a work enters the market for the very first time.

Limna.ai allows you to simply enter the artist’s name and the size of the painting and it shows you data on how much you should pay for the painting. If you have already received a price from a gallery or an art dealer, it helps you in verifying it. Using machine learning, Limna analyses millions of data points in seconds – tracking every exhibition and every art fair, along with extra information. Thanks to this process, what you get is an accurate valuation of the works that you are interested in.

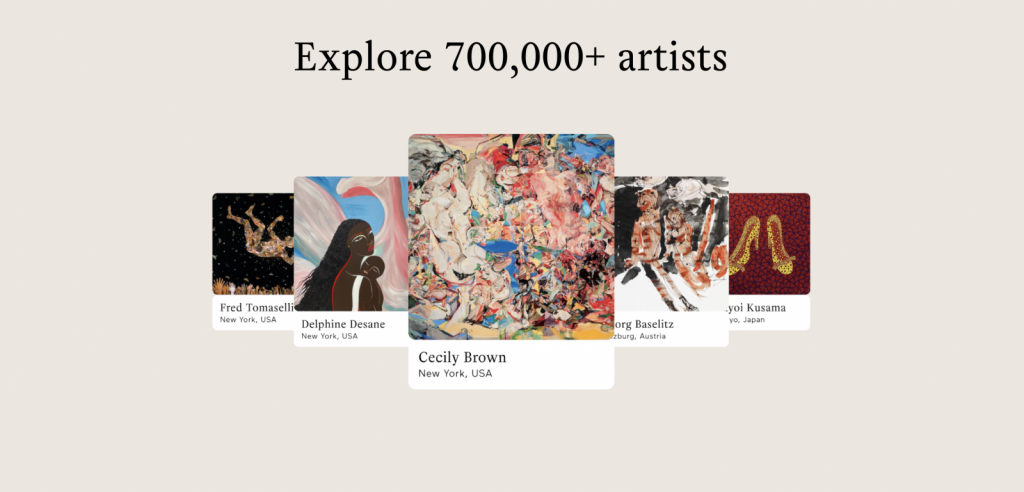

The algorithm takes into consideration factors from the start of an artist’s exhibiting career to the present day and even planned activity for the future, their sales history, size of the artwork, etc. Limna’s creators pride themselves on covering more than 700,000 painters in their database.

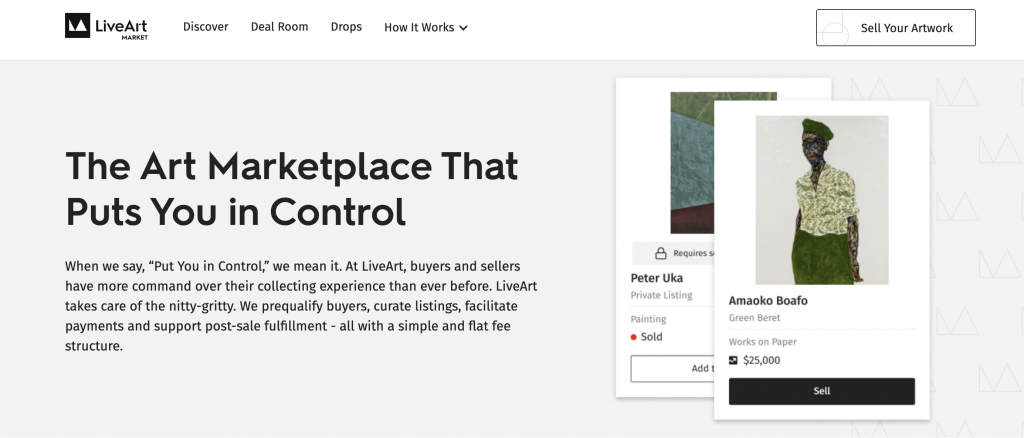

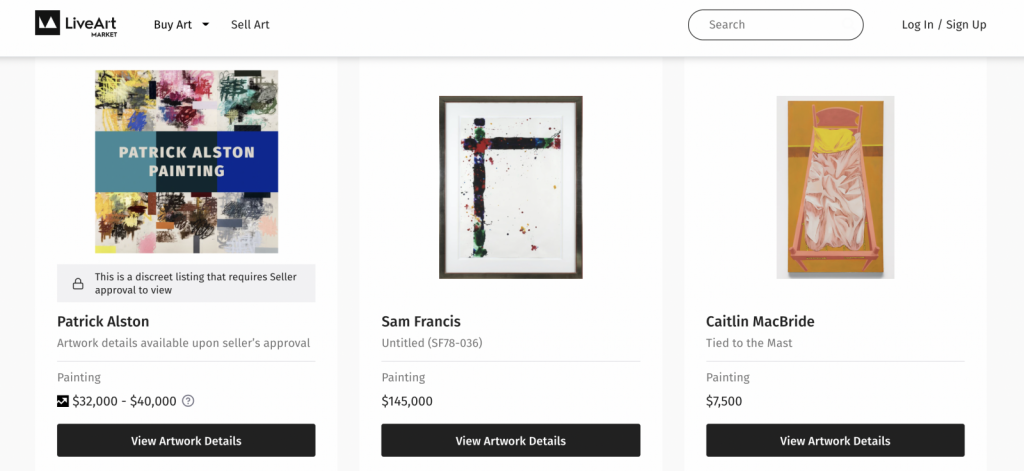

LiveArt Market is a peer-to-peer trading platform. Their motto is “Put You in Control” as the platform tries to give more command to both buyers and sellers over their collecting experience. What does the platform offer? The most important thing is that while anyone can browse the marketplace, only pre-qualified buyers can submit offers and request to view private listings. The platform also gives sellers the option of private sales. Sellers can submit their artworks anonymously and only verified buyers can request to view private listings and must be approved by sellers to see their private deal rooms.

LiveArt Market offers curated art listings for those with limited expertise in art. Together with Negotiations, Contracting, Shipping, and Inspection modes, the platform offers its users a complete art buying experience and takes care of all the details.

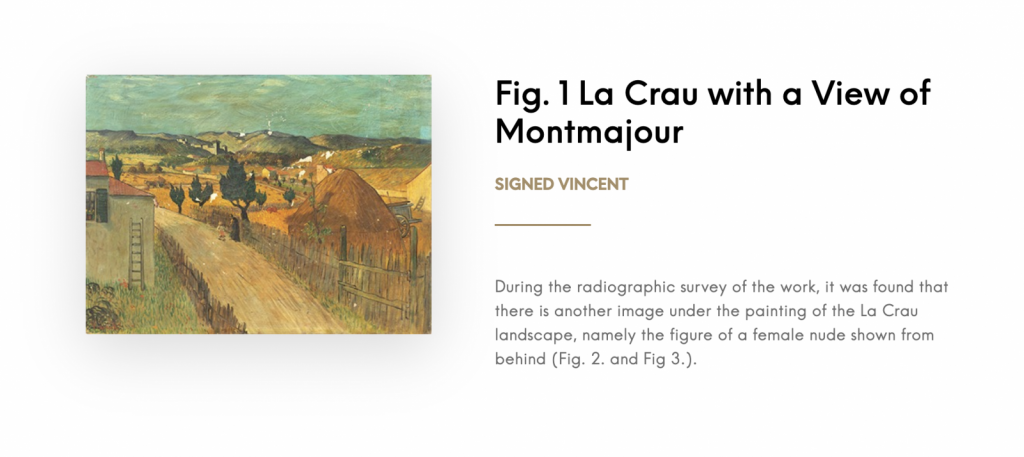

Another startup revolutionizing the art world is InsightART. The company has its main seat in Prague and has been on the market since 2018. It is a subsidiary of ADVACAM—a NASA-certified supplier and developer of patented WidePIX single-photon processing detectors that grew from Medipix chip research at CERN.

Their next-generation x-ray imaging technology was previously available only at the cutting edge of particle physics research. Startup’s mission is to create tools that are designed to assist art restoration experts and to unmask forgeries.

With this tool, it is possible not only to scan and analyze two-dimensional paintings but also three-dimensional sculptures and objects.

Will any of these companies become a unicorn? It depends, of course, on wider investment trends and the backing of VC funds. Although art tech uses a different language than traditional art, it all has the same roots. Most early-stage companies will probably fall, as the failure rate of startups is quite high, but some have a chance to become successful. Also, it is a very positive trend that VC funds have started noticing art as an important area of their future investments.

DailyArt Magazine needs your support. Every contribution, however big or small, is very valuable for our future. Thanks to it, we will be able to sustain and grow the Magazine. Thank you for your help!